PAMM FAQ

How PAMM Works

General Information

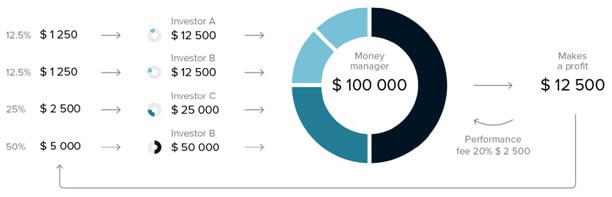

PAMM (Percentage allocation management module) is a form of pooled money forex trading. An investor gets to allocate his or her money to the qualified money manager(s) of his or her choice. These traders may manage multiple forex trading accounts using their own capital and such pooled money, with an aim to generate profits.

PAMM solution allows the trader on one trading platform to manage the simultaneously unlimited quantity of managed accounts. Depending on the size of the deposit each managed account has its own ratio in PAMM. Trader’s activity results (trades, profit, and loss) are allocated between managed accounts according to the ratio.

PAMM Accounts

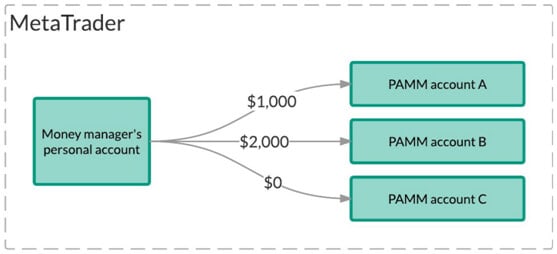

A PAMM account is a separate MetaTrader account where the funds of all investors are aggregated and where the money manager performs trading. Funds in PAMM accounts are managed exclusively by the plugin and should not be managed externally.

Each PAMM account is linked to the money manager’s personal (or owner) account. Each money manager may have multiple PAMM accounts. The number of active PAMM accounts per each money manager is limited by money manager configurations.

Trading in the money manager’s personal account is not affected nor controlled by the PAMM system in any way.

Trading Accounts

Created in the trading platform either by the PAMM system or the broker; it holds the funds of all the linked investors and own funds of the money manager.

This account is the place where the money manager trades. Any profit or loss originated from trades performed in the account is distributed between the investors and the money manager according to equity.

Any operations available in the trading platform are permitted in the trading account

Own funds & manager’s capital

Money managers may invest their own money into controlled PAMM accounts from their personal MetaTrader account. Money managers can view their own funds and other properties of their PAMM accounts in the PAMM web cabinet.

All the fees that the investors are charged are transferred to own funds of the money manager. Money managers may choose to withdraw all or part of their own funds back to their personal account. Own funds are also transferred back to the personal account in case the PAMM account is liquidated.

| Amount | Personal Account | PAMM Account Own Funds | MM Trading Account | |

| Deposit | $ 100 | -$ 100 | +$ 100 | +$ 100 |

| Withdrawal | $ 1,000 | +$ 1,000 | -$ 1,000 | -$ 1,000 |

| Fee from investor | $ 500 | – | +$ 500 | – |

Rollover

PAMM rollovers run periodically according to a schedule configured by the broker; possible periodicity:

- Manual – only manual rollovers

- Every 5, 15, 30 minutes

- Every 1, 2, 4, 6, 8, 12 hours

- Daily

Each rollover consists of:

- Trade results distribution

- Execution of confirmed deposit, withdrawal, close account requests

- Trading account balance synchronization (happens in case any errors occur)

- Daily

PAMM Account Offers

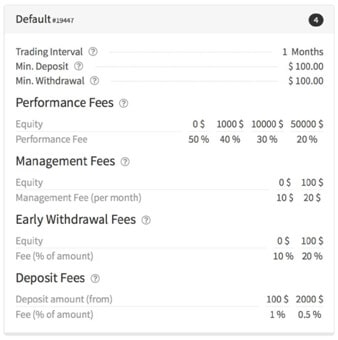

Each PAMM offer consists of the following:

- Trading interval

- Minimum deposit

- Minimum withdrawal

- Fees

An example of an offer:

Trading Interval

It defines how often investors are charged fees. The trading interval may be one of the following:

- Number of months

- Number of weeks

- Number of days

- Number of calendar months

In case the trading interval is set to be a number of months, weeks or days, interval start and end dates are different per each investor: start will be the first deposit request date and end will be calculated based on the defined value.

In case the trading interval is set to be a number of calendar months, the trading interval will always start on the first day of the month and end on the last.

Minimum Deposit

It defines the smallest amount that can be deposited to the investment. It applies to initial investment as well.

Minimum withdrawal

It defines the minimum amount of money that can be withdrawn from a PAMM investment at a time. It does not apply to investor account liquidation.

Fees

Fees may be enabled or disabled via PAMM account configurations. This means that each PAMM account may have different fees available to set up in the offer. For example, the broker may allow

- Only performance fees

- Performance and management fees

- etc.

Performance Fees

Part of profit gained by the money manager during the current trading interval for the investor gets transferred to MM’s own funds.

The performance fee is paid to the money manager either in the end of the trading interval on in case of early withdrawal by the investor.

In a case of losses in the investor account during the current trading interval, no performance fee is paid to the money manager. These losses are transferred to the next trading interval so the money manager must recover these losses in order to receive performance fees in the future.

There are two types of performance fees available in the system:

- Equity-based

- Return-based

Equity-based performance fees

The percentage of profit that is transferred to the money manager is decided based on the equity of the investment account. Levels of equity-percentage pairs are defined in the offer.

Equity defines the starting amount from which the corresponding percentage will be used (equity includes profit for the current trading interval).

Fee value defines the part of the profit that will be transferred to the money manager.

| Equity | $0 | $ 1,000 | $ 10,000 |

| Fee | 50% | 40% | 30% |

This fee structure means that:

- Investors with equity starting from $10,000 will pay 30% performance fee

- Investors with equity starting from $1,000 will pay 40% performance fee

- All other investors will pay 50% performance fee

| Equity at the end of the trading interval (including profit) | Trading interval profit | Performance fee(transferred to money manager) | Equity after paying out performance fees |

| $3,500 | $500 | 40% -> $200 | $3,300 |

| $600 | $100 | 50% -> $50 | $550 |

| $35,000 | $5,000 | 30% -> $1,500 | $33,500 |

| $90,000 | -$10,000 | 0 | $90,000 |

Return-based performance fees

In the end of the trading interval, PAMM will calculate TWR (Time-Weighted Rate of Return) for each investment account and pay out performance fees in the following way:

- TWR is split into multiple levels according to performance fee levels

- Profit is split according to TWR levels

- Performance fee is calculated per each level

- All the fees per each level are aggregated and transferred to the money manager

| TWR Levels | Performance Fee % | Abs Profit levels | Performance Fee values | ||

| TWR 35% | 30% | 50% | Abs.Profit 7,000$ | *5/35=1,000$ | *50%=500$ |

| 20-30% | 40% | *10/35=2,000$ | *40%=800$ | ||

| 10-20% | 20% | *10/35=2,000$ | *20%=400$ | ||

| <10 | 0% | *10/35=2,000$ | 0 | ||

| Total:1,700$ | |||||

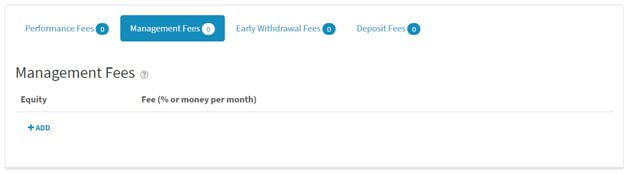

Management fees

A flat fee that the investor pays to the money manager based on his equity. The fee amount is a percentage of equity under management or a monetary value per month.

It will be paid out at the end of each trading interval.

| Equity | $0 | $ 1,000 | $ 10,000 |

| Fee | 1% | 0.5% | $100 |

| Equity at the end of the trading interval (including profit) | Management fee(transferred to money manager) | Equity after paying out management fees |

| $4,000 | 0.5% -> $20 | $3,980 |

| $600 | 1% -> $6 | $594 |

| $35,000 | $100 | $34,900 |

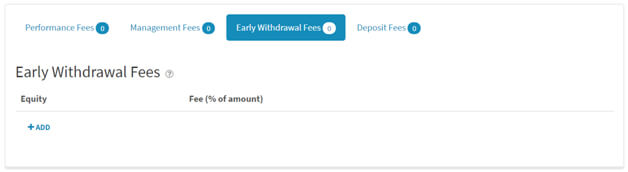

Early withdrawal fees

A percentage of withdrawal that is paid to the money manager in case the investor withdraws funds before the trading interval end.

Performance fees may depend on the total amount of funds of each investor. The withdrawal fee is deducted from the investor’s funds.

| Equity | $0 | $ 1,000 | $ 10,000 |

| Fee | 2% | 1% | 0.5% |

| Equity at the time of withdrawal | Withdrawal Amount | Early withdrawal fee (transferred to money manager) | Equity after withdrawal |

| $4,000 | $1,000 | 1% -> $10 | $4,000 – $1,000 – $10 = $2,900 |

| $600 | $100 | 2% -> $2 | $600 – $100 – $2 = $498 |

| $35,000 | $5,000 | 0.5% -> $25 | $35,000 – $5,000 – $25 = $29,975 |

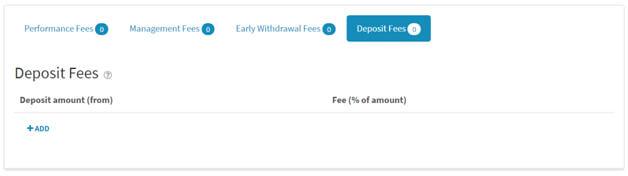

Deposit fees

A percentage of each deposit that is subtracted from the deposit amount and transferred to money manager own funds.

Deposit fees may depend on the total amount of the deposit.

| Equity | $0 | $ 1,000 | $ 10,000 |

| Fee | 2% | 1% | 0% |

| Deposit amount | Deposit fee (transferred to money manager) | Added to the investment |

| $4,000 | 0.5% -> $20 | $5,000 – $50 = $4,950 |

| $600 | 1% -> $6 | $500 – $10 = $490 |

| $35,000 | $100 | $15,000 |

Stopout Level

Stop out level refers to the point at which all the active positions in the trader’s account are automatically closed by the broker in order to protect the account from the levels beyond the maximum drawdown. It is set at % level as per the maximum drawdown provided by the trader.

Cookies are being used on our website. By clicking the 'Accept' you are agreeing to our cookie policy

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.