Copy Trade FAQ

How Copy Trade Works

General Information

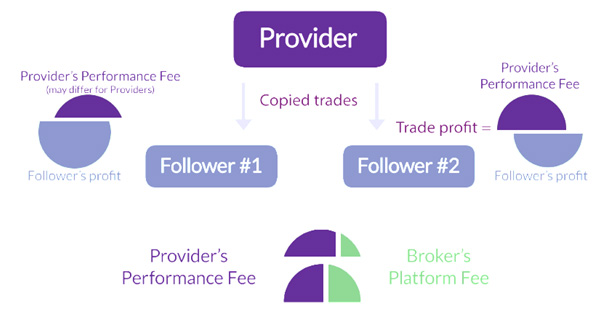

Copy trading is a form of following traders after looking over the trading performance and statistical data to make decision about which trader might be best suitable and capable to handle growth and stability as per high risk or low risk trading mechanism. An Investor can allocate his funds to variety of qualified traders of his/her choice. Traders may manage multiple forex trading accounts using their own capital and such pooled money, with an aim to generate profits.

Copy trading Solutions allows the Trader to showcase his trading skills and earn profit sharing fee as per set offer configuration and simultaneously it is beneficial for followers to follow professional traders those who are having capability to trade and perform to grow capital in a longer run. Depending upon the risk appetite follower can set the follower configuration accordingly with set risk mechanism to safeguard the invested capital.

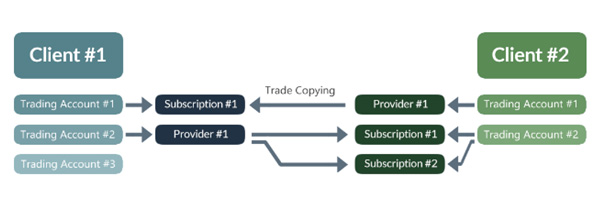

COPY Trading Account – Strategy Manager

A Copy Trading Strategy Manager Trading Account is different where he can trade freely without any risk of belief that he should have bigger Equity Account type trading size or he should match his trading account balance with his followers. Strategy Manager can trade freely with his own risk management mechanism and with his own invested money in his trading account.

COPY Trading Account – Strategy Follower

A Copy Trading Strategy Follower Account is where he can follow the Strategy Provider as per his own risk mechanism and parameters to follow any provider, even parameters like Symbol based copying, and Trade Direction Short/Long based copying can also be set in accordance with Strategy Follower Risk strategy.

Performance Fees

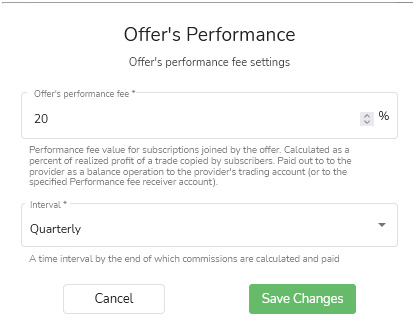

Strategy Manager can set his own performance fees as per respected tenure like

Daily,

Weekly,

Monthly,

Quarterly,

Half Yearly,

Yearly

as per High Water Mark basis profits generated by Strategy Manager Trading performance. Even the freedom of different Offers is given to Strategy Provider so that client can allocate different performance fee structure to different clients.

Once the Trading Interval end triggers, Copy Trading initiates payment of Performance Fees for each provider for an Individual follower. The resulting performance fees is withdrawn from the followers account and deposited to Provider’s fee Receiver account or to the provider’s trading account. Even different Offer Web Links can be generated to attract and target clients differentiating on the basis of various factors.

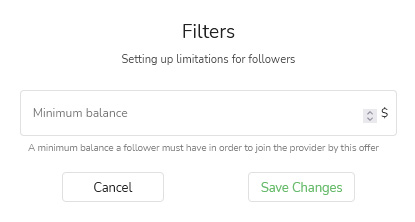

Setting up limitations for followers can be done via Filters section.

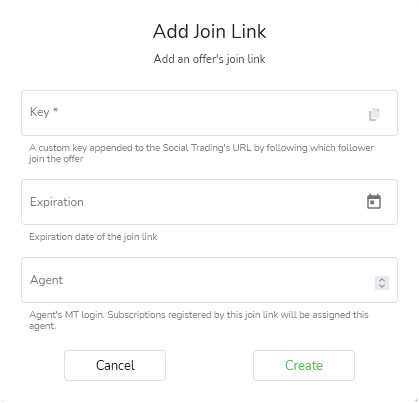

Setting up offer’s join links. Join link is the only way to follow a private provider.

Cookies are being used on our website. By clicking the 'Accept' you are agreeing to our cookie policy

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.